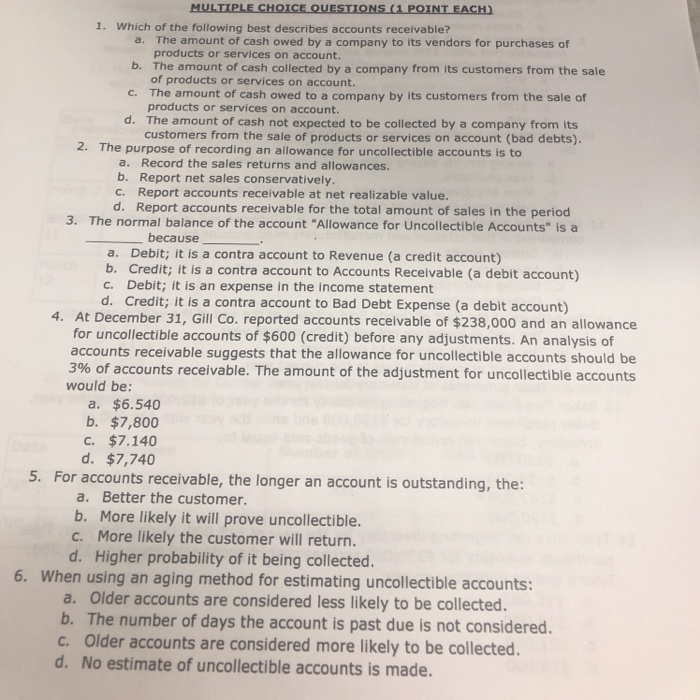

Which of the Following Best Describes Accounts Receivable

Trade or nontrade receivable 2. The primary difference between a note receivable and an account receivable is.

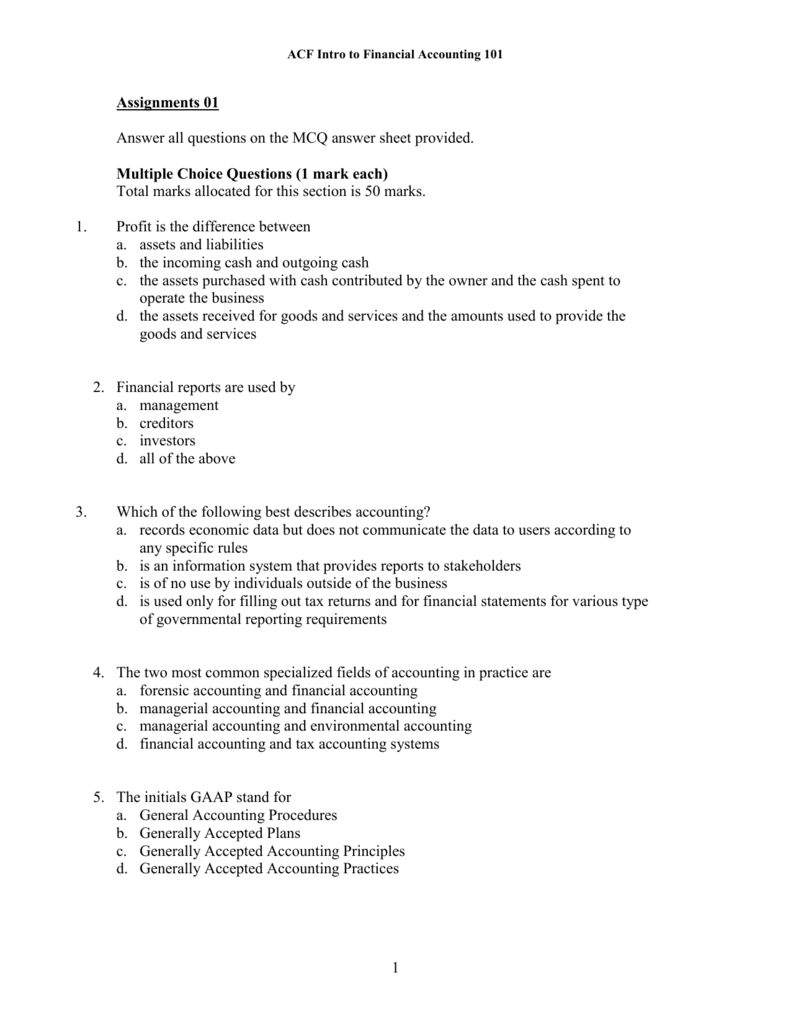

Solved 1 Which Of The Following Best Describes Accounting Chegg Com

When accounts receivable are confirmed at an interim date the auditors are not concerned with which of the following.

. The auditors observe all additions to plant and equipment made during the year. The normal balance of Accounts Payable is. A liquidity ratio that estimates how quickly an organization converts receivables to cash.

Which of the following statements best describes a positive request for confirmation of an accounts receivable balance. Credit sale is nothing. An account receivable is more likely to be collected.

Send letters to customers confirming outstanding accounts receivable balancesf. BAccounts receivable should be directly written off when the due date arrives and the customers have not paid the bill. Conversely the shorter the bills hold days and the higher the clean claims submission the lower the accounts receivable days.

Which of the following describes accrued revenue. Insurance Expense would appear on which of the following financial statements. The customer will be asked to respond to the confirmation request only if the balance indicated in the request is incorrect.

Cash sales to customers that are new to the company. Which of the following best describes accounts receivable turnover ART. Factored P750000 of accounts receivable to Thorne Company on December 3 year 2.

The greater the bill hold days and the lower the percentage of clean claims the higher the accounts receivable days. The adjustment causes an increase in an asset account and an increase in a revenue account. They refer to earnings which have been earned but not yet billed.

Answered Sep 12 2020 by ajijames. 2000 The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements which he believes will reduce accounts receivable days to the. A profitability ratio that measures how quickly an organization generates revenue B.

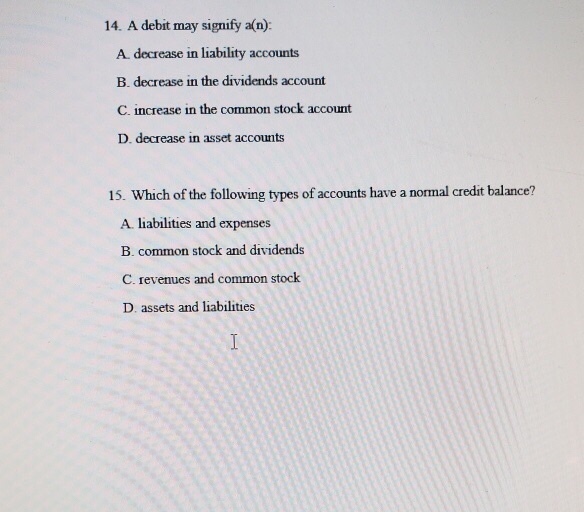

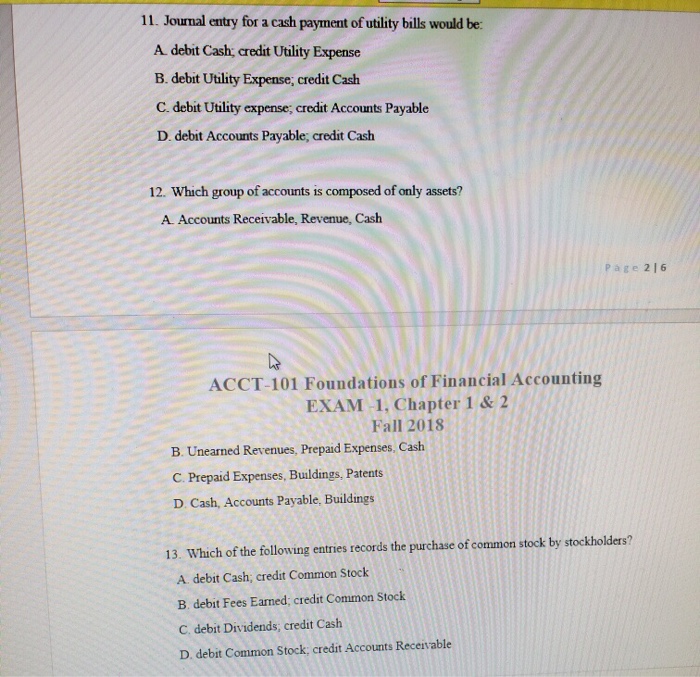

Which of the following statements regarding the accounts receivables turnover ratio is true. Which of the following best describes credit sales. ART is a measure of how many days are required on the average to collect accounts receivable.

A note receivable is evidenced by a written debt instrument. AAn accurate estimate of bad debt expense may be arrived at by multiplying historical bad debt rates by the amount of credit sales made during a period. A Accounts Receivable Explanation.

Adjustments involve increasing both an expense account and a liability account. Up to 25 cash back Which of the following best describes days in accounts receivable A. Group of answer choices ART is a measure of managements estimate of the ultimate collectability of average accounts receivable.

Which of the following best describes the operative chart of accounts. Thorne assessed a fee of 2 and retains a. Current or noncurrent 3.

Which of the following best describes the auditors typical observation of plant and equipment. Contains the operational accounts that are used to record the financial impact of an organizations day-to-day transactions. Check all that apply Multiple select question.

Which of the following best describes the proper presentation of accounts receivable in the financial statements. Which of the following best describes overtrading. Contains only accounts receivable transactions.

A Selling more than you can manufacture andor you hold in inventory. Control was surrendered by Signal. The customer will be asked to indicate to the auditor the current balance in the account.

Accounts receivable is usually increased when accruing revenues. Which of the following most accurately illustrates the effect of the increase in tax rate on the deferred tax accounts. Which of the following best describes the concept of the aging method of receivables.

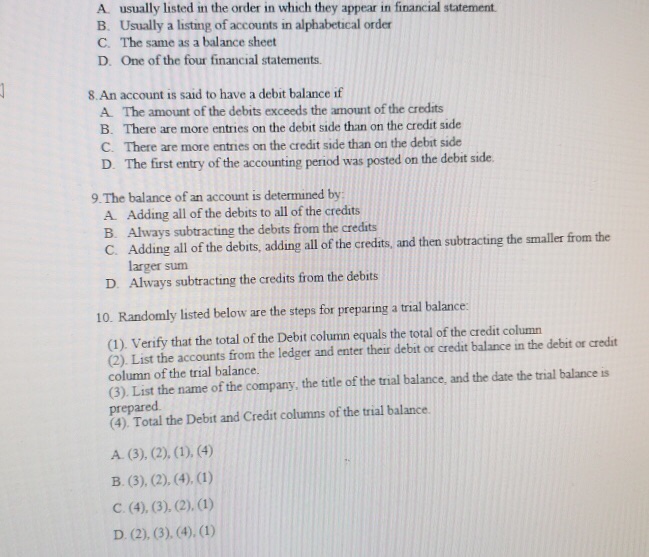

Coolwear wrote off 820 in accounts receivable and determined that there should be an allowance for uncollectible accounts of 1140 at December 31 2016. Answer Explanation Answer. Confirmation of accounts receivable is presumptively a mandatory audit procedure.

The journal entry to record a credit sale is Accounts Receivable. In performing this procedure auditors use positive confirmation requests or negative confirmation requests or a combination of both. Companies of similar size operating in the same country tend to have similar receivables turnover ratios c.

Considering the necessity for some additional confirmations as of the balance sheet date if balances have increased materially. Perform analytical procedures comparing the client with similar companies in. What factors can cause a patient account balance to display a negative amount.

The tutor can help you get an A on your homework or ace your next test. A note receivable cannot be classified as a current asset. When accounts receivable are confirmed at an interim date auditors need not be concerned with.

Borrowers have the option of not paying a note receivable. 2 3 4 CLOs. Bad debt expense for 2016 would be.

Select one or more. Which of the following best describes accounts receivable. Sales to customers using credit cards.

2 3 Prior to beginning work on this discussion forum read Chapters 10 and 11 in the course textbook. Accounts or notes receivable. A company has reported total deferred tax assets and liabilities amounting to 35000 and 50000 respectively in its balance sheet for the year ended 2012 In the fiscal year 2013 the statutory tax rate increased from 30 to 35.

Asked Nov 7 2021 in Business by rosacat. The accounts receivables turnover ratio indicates how many times on average the process of selling to and collecting from customers occurs during the accounting period b. They refer to revenues that are earned in a period but have not been received and are unrecorded.

Thorne accepted the receivables subject to recourse for nonpayment. The adjustment causes an increase in an asset account and an increase in a revenue account. Statement of Owners Equity.

Accounts Receivable plus the Allowance for Doubtful Accounts in the asset section of the balance sheet. In which of the following statements best describes a positive request for from ACCOUNTANC 1A at The Institute of Company Secretaries of India. Select one or more.

Solved Multiple Choices 50 Points 1 Which Of The Chegg Com

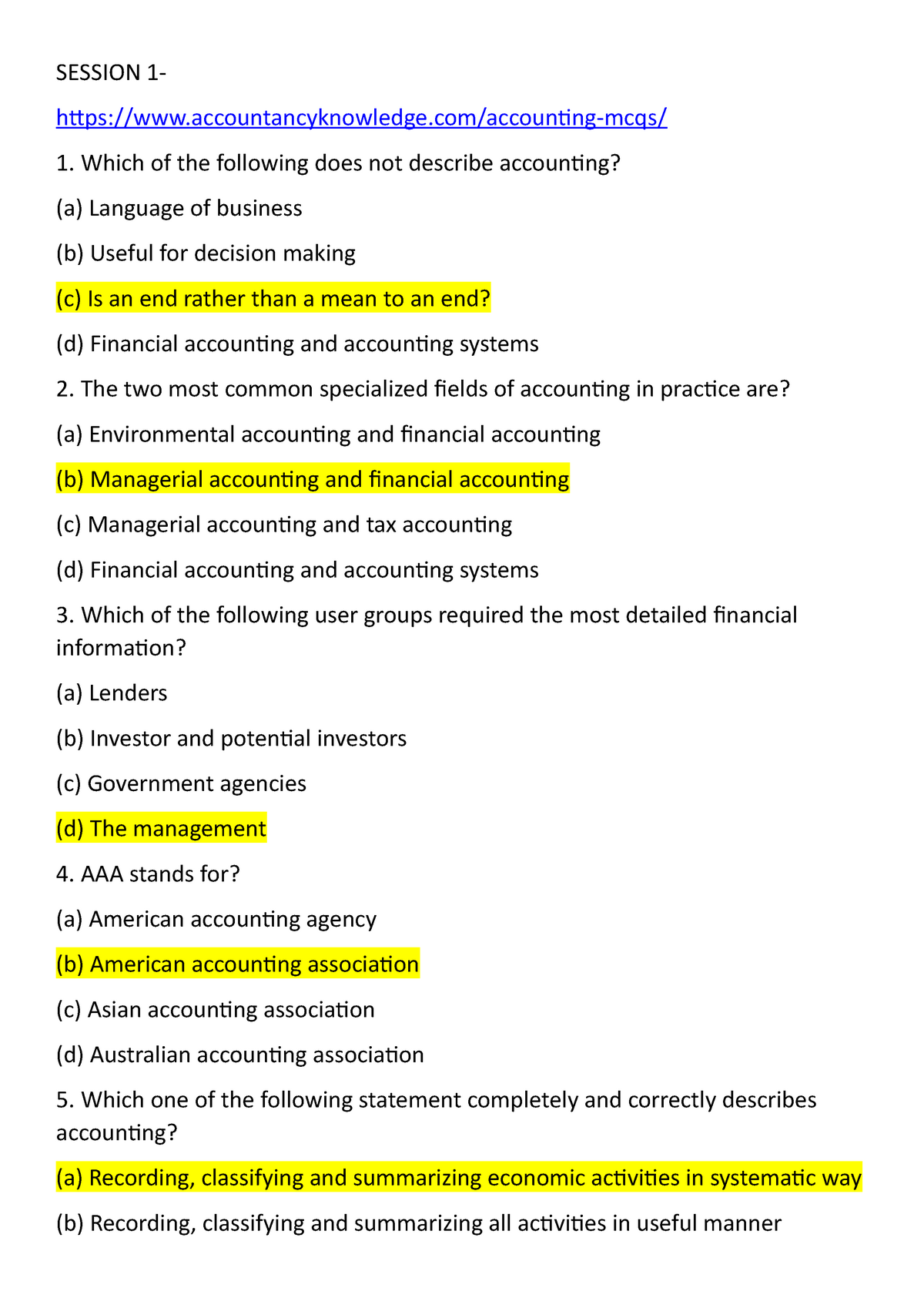

Accountancy Knowledge Mcqs Session 1 Accountancyknowledge Accounting Mcqs Which Of The Following Studocu

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Balance Sheet Template Trial Balance

Solved 1 Which Of The Following Best Describes Accounting Chegg Com

Solved Multiple Choices 50 Points 1 Which Of The Chegg Com

Hsm 543 Week 1 Quiz Summer 2018 Quiz Exam Homework Assignments

Solved Multiplechoice Ouestionslipointeachi 1 Which Of The Chegg Com

Provide The Reagents Necessary To Carry Out The Following Conversion In 2022 Carry On Conversation Following

Accounting Software Describes A Sort Of Application Software Package That Records Accounting Transactions Inside U Accounting Software Business Blog Accounting

Solved 1 Which Of The Following Best Describes Accounting Chegg Com

Processing Accounting Information

Account Receivable Ar Incoming Payment Process In Sap This Process Definition Document Describes The Process Accounts Receivable Accounting Payment Processing

General Ledger Accounting Play General Ledger General Ledger Example Accounting

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Credit Card Balance

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Purchase Order Template 27 Free Docs Xlsx Pdf Forms Purchase Order Template Letter Template Word Invoice Template Word

How To Convert Cash Basis To Accrual Basis Cost Of Goods Sold Business Tax Deductions Cost Accounting

Comments

Post a Comment